Porsche isn’t doing so hot right now. The performance-luxury brand was, up until recently, a money-printing, high-margin machine for VW Group, but tanking China sales, U.S. tariffs, and a weakening demand for electric cars have put the brand in a tough spot.

In Porsche’s quarterly report, the company said the above challenges have led to a “significant impact on earnings” for the year so far. Specifically, it means a 99% drop in operating profit, from $4.68 billion in the first nine months of the year to just $46 million. That is an incredible swing in just one year.

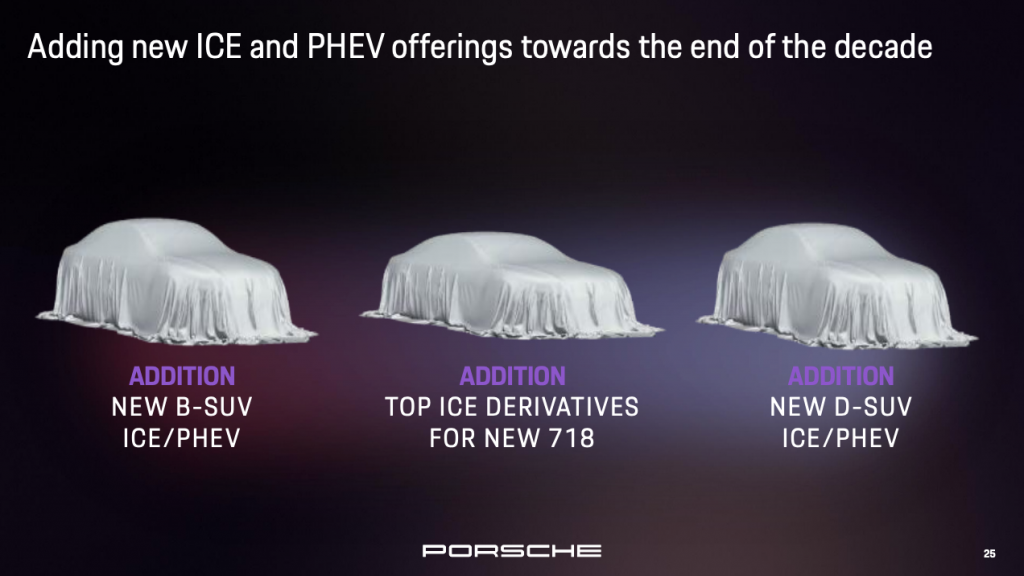

That disappearing profit has a lot to do with Porsche’s “realignment” of its product portfolio. The company planned an onslaught of EVs to replace its current lineup, but with the demand for such vehicles weakening worldwide, it has had to backtrack and rethink its offerings, which will now include more gas-powered cars and hybrids.

Despite record deliveries in the U.S., tariffs have meant increased costs “within mid three-digit million” euro range. This has, in part, led to operating return on sales—the number that measures how efficiently a company can turn sales into profit—to drop from 14% to just 0.2% (or, as close to zero as possible).

Those record deliveries in America weren’t enough to bolster global sales. Deliveries worldwide are down 6% versus the same period last year, to 212,059 units. That’s mainly thanks to China, where sales have tanked as cheaper, more appealing options from domestic automakers become more widely available.

All of these things, combined, have led to a perfect storm of badness for Porsche. The company declared an operating loss of 966 million euros ($1.1 billion) for the quarter, far higher than what analysts expected, according to Reuters.

Fixing the profitability issue will come down to how Porsche executes that realignment. The company’s Q3 results presentation puts a great deal of emphasis on exclusive, low-production models, customization options, and tech features launched in 2025, using stuff like the Cayenne Electric’s wireless charging as an example.

Porsche also mentions something called the “Future Package,” a plan it describes as a “rescaling” of its employee numbers within the company. The plan, according to the company’s presentation, will take “socially responsible measures to optimize corporate structure and strengthen future resilience.” CFO Dr. Jochen Breckner laid things out plainly:

In October, Porsche initiated talks between management and employee representatives on a Future Package, as announced. “We have to assume that the general market conditions will not improve in the foreseeable future. That is why we need to discuss large-scale solutions in all areas – including in the context of the Future Package,” emphasizes Breckner.

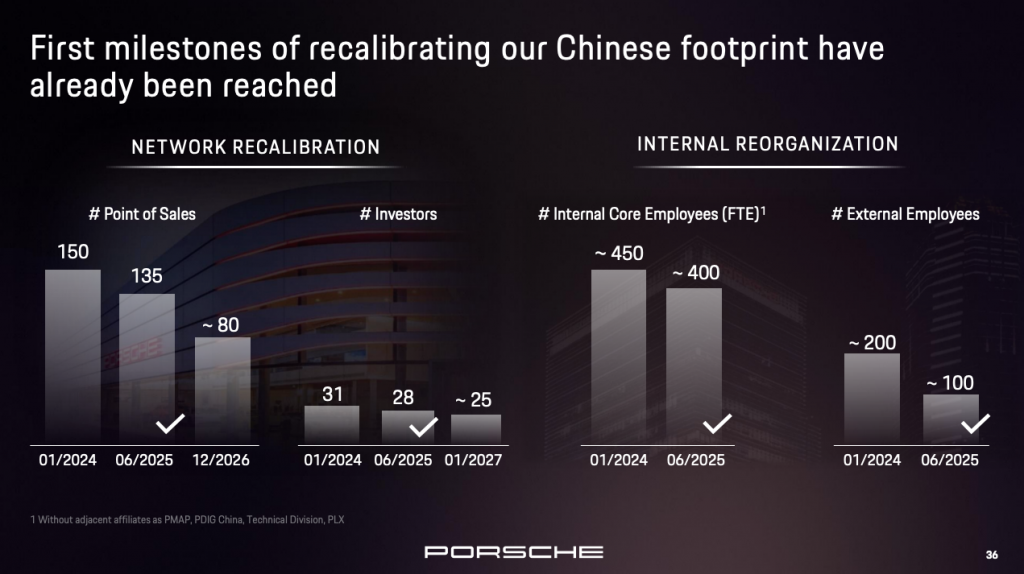

All of these words are, if you’ve followed the chaotic world of the German automotive sector closely, just fancy terms for layoff negotiations, whether that be through voluntary buyouts, early retirement packages, or simple job eliminations. Porsche went as far as to show off how much it’s downsized in China this year, and suggested there’s more to come:

Breckner also didn’t shy away from pointing out what virtually everyone in the industry knows already: Things ain’t getting any rosier. Tariffs are seemingly here to stay, at least for the next three years. Likewise, the sales of EVs are expected to remain flat, or even decrease, over that same period, at least in the United States. And China’s influence on the industry is only going to get larger over time. So Porsche is making some tough decisions to stay relevant.

A lot of that pressure to turn the ship around rests on the shoulders of Michael Leiters, former CEO of McLaren. Leiters steered the British supercar company out of the pandemic years and oversaw launches of the Artura and the 750S before leaving the company in May of 2025. Previously, he served as CTO of Ferrari, where he oversaw development of the all-important Purosangue SUV, and helped develop the brand’s first two hybrids, the SF90 and the 296. Before that, he worked at Porsche as the company’s product line director.

Whether Porsche will see a “noticeable improvement” in financials from 2026 onwards, as Breckner says in this latest summary of results, isn’t clear. So long as it keeps building 911s, Caymans, and Boxsters with manual transmissions, I’ll be happy.

Top photo: Porsche

MANUAL BASE 911. BRING IT BACK. BONUS POINTS IF NATURALLY ASPIRATED. DO YOU KNOW HOW MANY PARSHTHUSIASTS WOULD POOP THEIR PANTS IN GLEE OVER THAT??????!!!!

My biggest worry with bringing in a McLaren guy is that McLaren doubled down even harder on a sin Porsche’s started doing: an excess number of special editions. When everything’s a limited-run special edition, nothing is special anymore.